A quick insight: Financial services employees are among the most passionate and committed in any industry, yet many feel unheard, overworked and unsure of their growth prospects. Engagement data shows that while most care deeply about their organisation’s success, weak communication, limited development opportunities and heavy workloads are driving frustration. Addressing these barriers through stronger leadership, actionable surveys and open dialogue is the key to building lasting engagement.

When it comes to engagement, few sectors carry the same intensity as financial services.

The stakes are high, regulation is constant and precision is everything. Employees are often motivated by purpose, challenge and ambition. However, the same pressures that drive performance can also lead to disengagement and burnout.

Our latest People Insight data paints a mixed picture. Employees in financial services demonstrate impressive loyalty, but their experience of communication, development and recognition shows room for improvement. Let’s take a real look at what the employee survey data says, what’s driving engagement and what the sector can realistically do to turn things around.

Related: What are the barriers to employee engagement in construction?

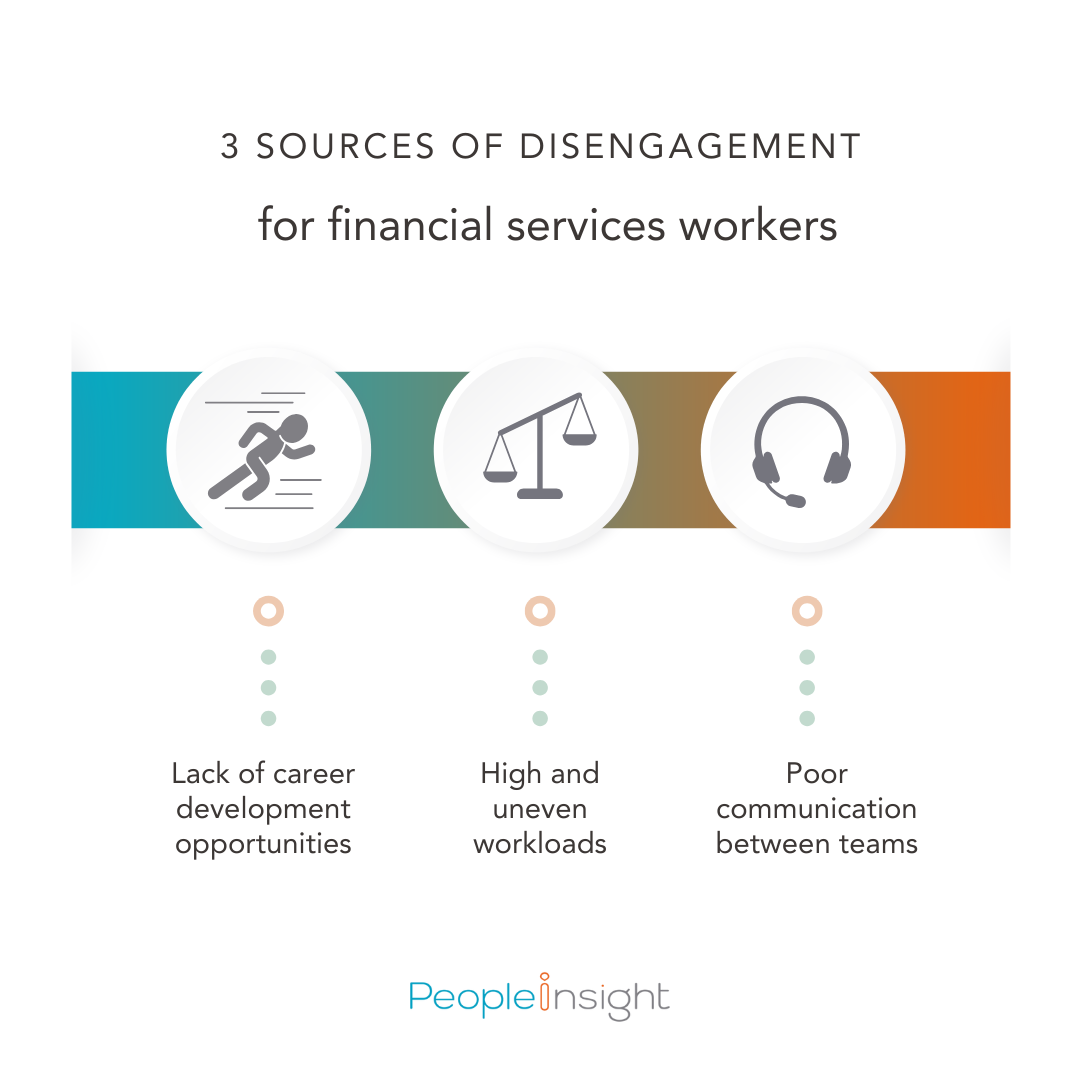

Employee disengagement rarely stems from a single cause. In financial services, it’s often the result of several overlapping pressures, including long hours, complex regulation, limited flexibility and communication breakdowns between departments.

Understanding where these issues intersect helps organisations target the right solutions and create change that employees can genuinely feel. So let’s take a deeper look.

This is a recurring problem across sectors, and financial services is no exception. Our data shows that only 53% of financial services employees say communication between teams is good. And while this issue is a problem across the board, the reality is, this is one of the lowest figures across all sectors we benchmark for this issue. In an industry that depends on coordination between departments, from compliance and risk to client-facing roles, communication gaps create inefficiencies and frustration.

When information flows poorly, employees can feel excluded from decisions that affect their work. It can also impact accuracy, client service and even regulatory compliance.

To improve this, organisations should invest in structured communication rhythms such as regular cross-team huddles or project briefings. Leadership communication is also really important. Leaders should model transparent communication by sharing updates and decisions openly.

Visual tools like digital dashboards can help teams see priorities and progress in real time. When communication improves, employees feel more connected, informed and trusted, all strong drivers of engagement.

Career development is another pressure point and source of disengagement for the financial services sector. Only 56% of financial services employees feel their career development aspirations are being met. That figure highlights a serious disconnect between ambition and opportunity.

Many employees in the sector are high achievers who expect clear progression pathways. Yet with flat organisational structures and constant change, those pathways are not always visible. The result is frustration and attrition among talented employees who feel stuck.

To address this, organisations should focus on transparent progression frameworks and access to professional development. Internal mentoring programmes, accredited training and secondments into different teams can all help. Managers should also make time for career conversations, or take the time to invest in career development frameworks. Even a short check-in about development goals shows employees that their growth matters.

Workload is a long-standing challenge in financial services. While 68% of employees say they can manage their workload comfortably, that leaves 32% who don’t agree that they can. The consequences of overwork include burnout, absenteeism and reduced quality of output, all of which have financial implications for the business. In fact, experts are warning of the risk of burnout for financial services employees as a result of increasing pressures and demands.

Workload management begins with honest dialogue. Managers should discuss capacity during one-to-ones and performance management discussions so they are able to spot early signs of overload. Technology and automation can also help free up time for higher-value work. For instance, automating data entry or reporting processes allows employees to focus on analysis and decision-making instead.

Beyond efficiency, leaders must create psychological safety for employees to speak up when they are overwhelmed. Too often, financial services culture rewards endurance over balance. Shifting that mindset takes consistent leadership behaviour and visible action to prioritise wellbeing.

Despite the challenges, financial services employees have much to be proud of. Our data shows that 92% care about the future of their organisation and 81% find their work interesting and challenging. These are remarkably high figures, reflecting a workforce that is motivated and committed.

Relationships with managers are also relatively strong. Around 71% of employees say their manager takes time to coach and develop their skills, a solid foundation to build from. Engagement initiatives should focus on amplifying these strengths through better communication and development opportunities.

Employee engagement cannot be fixed with perks or slogans. It requires listening, taking action and showing progress. The following steps will set organisations in good stead:

Leadership capability makes or breaks engagement. Only 68% of employees say they receive regular feedback from their manager, and just 59% believe action will be taken after a survey. Leaders who communicate clearly, coach regularly and follow through on promises create credibility. Investing in 360 feedback and leadership coaching helps managers develop these skills and sustain them over time.

Workplace wellbeing in financial services is often seen as secondary to results. Yet research shows that poor wellbeing directly impacts productivity and retention. Wellbeing programmes, workload planning and open conversations about stress can reduce burnout and increase loyalty. Simple actions like recognising achievements, offering wellbeing days or promoting flexible work patterns can make a measurable difference.

Related: Check out these wellbeing initiatives far sweeter than free cake

Employees in the sector are usually, unsurprisingly, data-driven. They expect transparency and accountability when they provide feedback. Sharing survey results and explaining what actions will follow builds trust. A “You said, we did” communication campaign is a clear way to demonstrate progress and reinforce employee voice.

Financial services operates under unique regulatory pressures, and engagement strategies need to reflect that. This means balancing innovation with compliance, autonomy with accountability and ambition with sustainability. Tools like Prism use AI to help identify where these tensions sit and guide data-driven action plans.

Financial services organisations often excel at financial data but struggle with people data. Engagement metrics are not just another dashboard to report upwards; they are insights into how people feel, perform and connect.

The good news? Engagement in this sector is far from broken. It simply needs attention in the right areas, communication, development and wellbeing. When these areas improve, the impact ripples across customer satisfaction, retention and organisational reputation.

At People Insight, we work with financial services organisations to turn survey insights into meaningful change. Our actionable financial services employee surveys help leaders take confident, data-informed steps to strengthen engagement. Get in touch today to learn how we can help your people feel heard, valued and supported.