- Employee Surveys

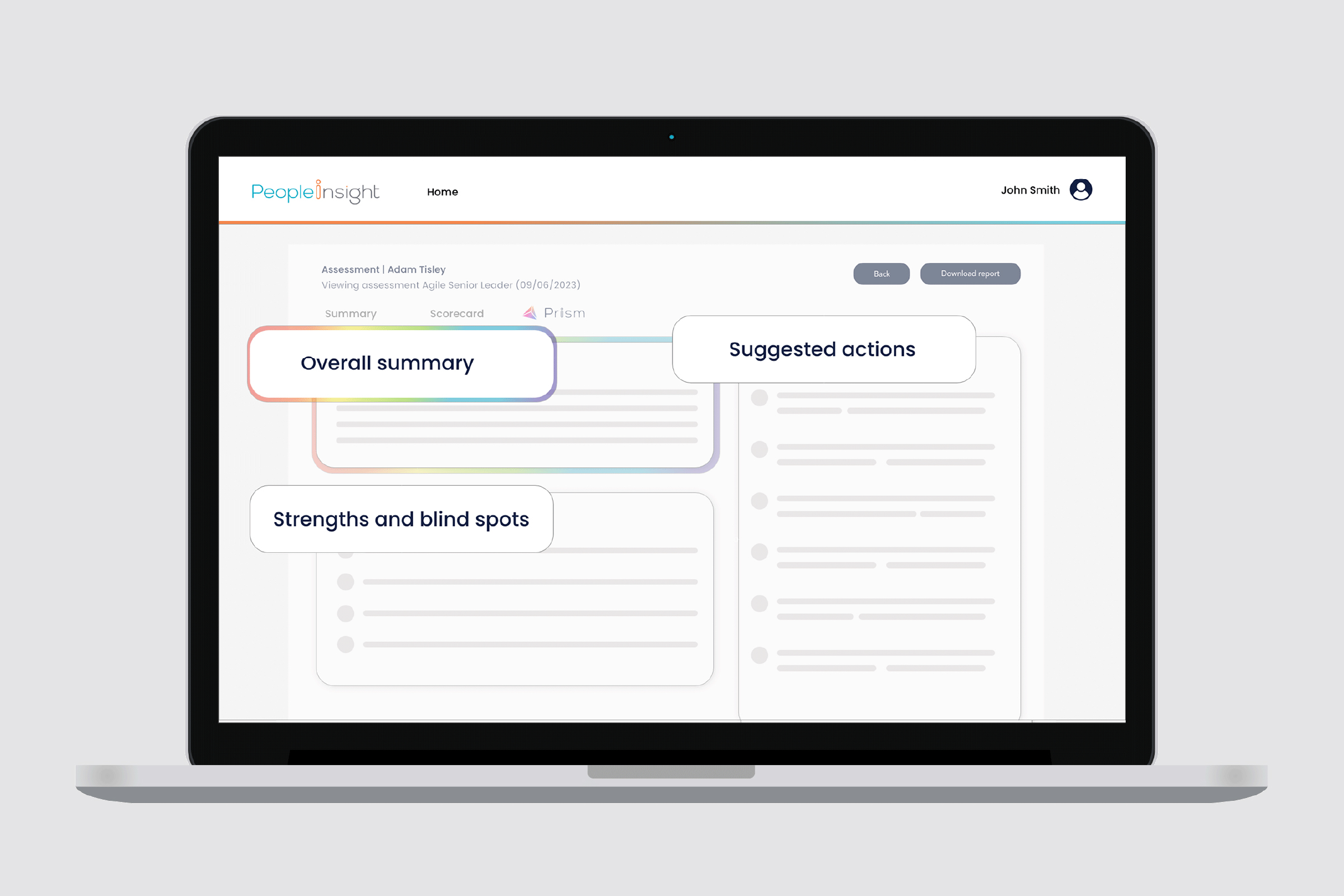

- 360 Feedback

- Consultancy

- Sectors

- Resources

-

-

-

Recent Posts

- What academic staff really think about work — what the data reveals

- What is democratic leadership? Pros, cons and mastering the style

- Leaver survey questions: Free employee survey questions

- Ageism at work: are older employees being left behind?

- Teaching in further education: Engagement boosts & barriers

-

-

- Pricing

- Contact